How to choose the best Home Loan?

Your home could possibly be the biggest purchase of your life. Unless you are born with a fat inheritance, if not, most of us would look to get a housing loan to get that dream house. So how to get the best deal in housing loan? how do you find the lowest rate?

Fixed or Variable Rates?

Firstly, you have to opt for either fixed rates or variable rates. Banks and financial institutions will package their housing loan according to fixed or variable rates.

For those who prefer stability, fixed rate loans may seem more appealing. It would mean that you enjoy no fluctuation in your monthly loan payments, no matter what is happening around the world. However, the fixed rate is not unchanged for infinity and the banks conventionally charge a different rate after a certain locked-in period. It is also worthy to note that fixed rate home loan carries a higher interest rate compared to a variable loan.

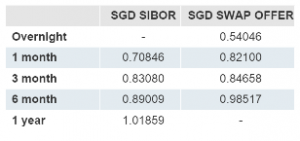

Variable or floating-rate home loans usually have a much lower interest rate for an initially lock-in period. The changes in its interest rate after the lock-in period are dependable on SIBOR (Singapore Inter Bank Offset Rate) or SOR (Swap Offer Rate). The lock-in period for variable rate is usually shorter than fixed-rate home loans.

As such, you may have to study the economic market beforehand and assess whether if it is a good time to take on that variable rate home loan.

If you look at the chart here, you will see that both SIBOR and SOR rates have reached closed to 1 percent. If you think that they might raise further down the road, taking a fixed rate loan may be better in helping you to lock in the current lower interest rates.

Buying to stay or Invest?

You need to first check whether your CPF account, savings and general financial ability to understand how much you can, or want to borrow. Banks can approve up to 80% loan if you are getting your first home. For home owners who are buying a place to stay, most often they would max-out their savings and CPF accounts to borrow the least, so as to minimise the interest payable from the mortgage loan.

For investors who are looking to make money from capital gains, they would usually want to borrow the maximum amount they can. They would also prefer a loan package with the shortest lock-in period so as to enjoy a greater flexibility when it comes to managing their property.

Are you looking to refinance an existing loan?

Make sure that you do not refinance an existing mortgage loan before the lock-in period as you may incur penalty fees. Some banks also charge legal fees if you are switching banks for the new loan.

Believe it or not, mortgage loans are meant for haggling. Don’t be shy to ask for better rates and subsidies especially for administrative fees or legal fees.

It is especially important to look at the cumulative interest payments instead of just the advertised rates on mortgage loans. The cumulative interest is the total interest payment throughout your loan period. You want this number to be as low as possible as this is effectively the cost of loan. Not only is this helpful to decide whether it is worthwhile to switch your loan to another bank, it also gives you a better idea of how much “extra” money you are paying for your loan. Once you feel uncomfortable with the number you see on the cumulative interest payments, you might consider repricing with the same bank you took the loan from.

If you are interested to compare home loans in Singapore, then make an informed decision with our home loans comparison engine and speak with our specialist team.